Energy analyst Scott Luft has been following the last few windy days, and has documented what sales of surplus power has done to Ontario. It’s not good. It’s really bad, in fact.

Wind kills Ontario market

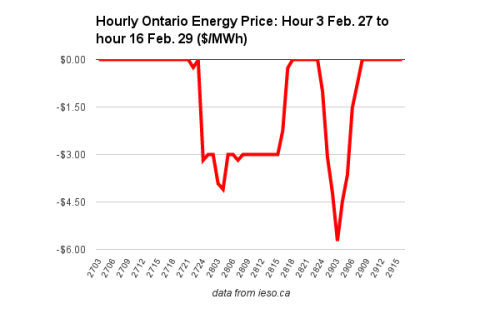

Ontario’s electricity market hasn’t had a positive hourly rate in 62 hours.

Apologists could offer a variety of contributors to the pricing, but I won’t.

Wind forecast, provided by the IESO in their hourly “Generators Output and Capability Report” updates, show the highest 14 hours of potential wind production in the history of the province during the 62 hour period, including a record 3695 megawatts for hour 14 this afternoon.

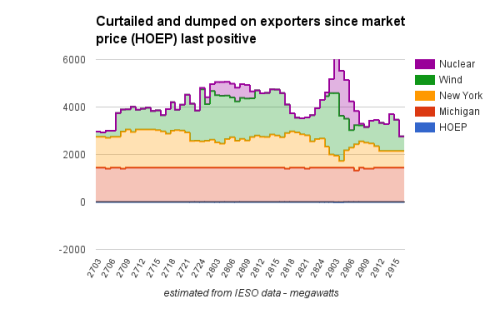

Ontario currently has about 4000 megawatts on wind capacity attached to the IESO’s grid – although the IESO is still only showing 3,234 MW in its summary of supply.

No records have been set for output to the grid from Ontario’s Industrial Wind Turbine over the period, because the grid can’t accept all the supply. My estimates show as much as 6000 megawatts curtailed, or dumped on exporters, during the 2 ½+ days.

There are costs to this windy weekend. Today the IESO estimated the February global adjustment charge, to be added to the bills of Ontario’s consumers, at $96.78/megawatt-hour (MWh) – which will bring the average rate up above the $107/MWh regulated price plans of households average. At that rate, curtailed wind and nuclear and excess dumped into New York and Michigan had a value of over $27 million in these 62 hours.

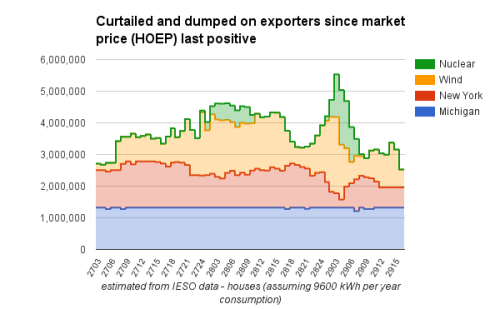

The numbers might be confusing. I’ve noticed many people now provide data in units of housing, expecting people to understand that.

Maybe simpler units would be number of residential Ontarios. The data on this chart ranges from the equivalent of half of Ontario’s households (~5 million) to a little over all of them.

spreadsheet

4 Comments

Peter Burgess

Is there any interest by the IESO/OPA to have the Global Adjustment or a portion thereof added to the HOEP?

Scott Luft

No, the opposite is true. Shifting the price to the global adjustment lowers the cost for Ontario’s largest consumers (those with a monthly peak demand over 3000 kilowatts).

A low HOEP is the industrial pricing policy.

Peter Burgess

Hi Scott,

Thanks for the reply. I am not that familiar with Ontario pricing but I’m certain the larger consumers pay Global Adjustment… Type A.. so I’m still a bit confused who/what keeps the GA out of the HOEP.

Scott Luft

That’s right.

Class A consumers pay a share of the global adjustment base on 5 hours a year – the high 5 coincident peaks (5 CP). Each Class A consumer will be different, but on average the pay a share of the global adjustment considerably smaller than their collective share of consumption (I think it’s about 19%) is considerably smaller than the share of the global adjustment they are charged for (about 12%).

The HOEP is the same for all, but the global adjustment is not.

I wrote on this in http://coldair.luftonline.net/2015/05/stakeholders-destroying-viability-of.html